MarTech for Niche Industries: Custom Solutions for Healthcare, Finance, and B2B

Picture this: A healthcare provider tries to implement a standard marketing automation platform, only to discover they can't store patient email addresses without violating HIPAA regulations. A financial services firm spends millions on a CRM system that doesn't account for their complex regulatory reporting requirements. A B2B manufacturer struggles with a marketing stack that can't track the 15+ decision-makers involved in their average sale. These aren't hypotheticals—they're daily realities for organizations trying to force-fit generic MarTech solutions into highly regulated industries.

The global MarTech industry, valued at $344.8 billion in 2021, is projected to reach $1.4 trillion by 2027. Yet despite this explosive growth, niche industries continue to struggle with off-the-shelf solutions that don't address their unique compliance requirements, customer journeys, and ROI metrics.

Healthcare MarTech: Where Patient Privacy Meets Personalization

The healthcare industry operates in one of the most heavily regulated environments, where a single data breach can result in millions in fines and irreparable damage to patient trust. According to the Department of Health and Human Services, HIPAA violations have cost healthcare organizations over $28 million in settlements in the past year alone.

Typical Healthcare MarTech Stack Components:

- HIPAA-compliant CRM (Salesforce Health Cloud, Microsoft Dynamics 365 for Healthcare)

- Secure patient communication platforms (Twilio Health, Relatient)

- Healthcare-specific marketing automation (Healthgrades, PatientPop)

- Analytics tools with built-in PHI protection (Adobe Analytics Healthcare)

- Consent management platforms (OneTrust Healthcare)

Key Regulatory Considerations:

HIPAA Compliance Requirements

- Privacy Rule: Governs use and disclosure of protected health information (PHI)

- Requires patient authorization for marketing communications

- Mandates minimum necessary standard for data access

- Enforces strict data sharing limitations between departments

- Security Rule: Establishes national standards for electronic PHI

- Requires encryption for data at rest and in transit

- Mandates access controls and audit trails

- Requires regular security risk assessments

- Breach Notification Rule: Requires notification of PHI breaches

- 60-day reporting window to affected individuals

- Notification to HHS and media for large breaches

- Documentation and investigation requirements

FDA Marketing Regulations

- Off-label promotion restrictions for pharmaceuticals and devices

- Fair balance requirements in drug advertising

- Substantiation requirements for health claims

- Pre-approval requirements for certain marketing materials

State-Specific Healthcare Privacy Laws

- California Confidentiality of Medical Information Act (CMIA)

- Texas Medical Records Privacy Act

- New York's stricter consent requirements for HIV/AIDS information

- State-specific mental health information protections

International Healthcare Data Regulations

- GDPR requirements for EU patient data

- PIPEDA compliance for Canadian patients

- Australia's Healthcare Identifiers Act

- Cross-border data transfer restrictions

The AI and Machine Learning Challenge:

Healthcare organizations face unique challenges when implementing AI and machine learning in their MarTech stacks. While these technologies can dramatically improve patient engagement and care outcomes, they must be designed with privacy-by-default principles. For instance, machine learning models must be trained on de-identified data, and any predictive analytics must comply with HIPAA's minimum necessary standard.

ROI in Healthcare MarTech:

Direct ROI Metrics

- Patient Acquisition Cost (PAC): Average cost to acquire new patients

- Benchmark: $314 per patient for primary care

- Goal: Reduce by 20-30% through targeted campaigns

- Patient Lifetime Value (PLV): Total revenue per patient relationship

- Average: $12,000 for primary care patients

- Increases to $200,000+ for chronic care management

- Appointment No-Show Reduction: Financial impact of missed appointments

- Average cost per no-show: $200

- Target reduction: 25-35% through automated reminders

- Patient Portal Adoption: Cost savings from digital engagement

- $8.21 saved per digital vs. paper interaction

- Target adoption rate: 60-70% of patient base

Clinical Outcome Metrics

- Readmission Rate Reduction: 30-day hospital readmission prevention

- Average cost per readmission: $15,000

- Target reduction: 12-18% through follow-up automation

- Medication Adherence Improvement: Compliance with prescribed treatments

- Non-adherence cost: $100-300 billion annually in US

- Target improvement: 20-25% through engagement programs

- Preventive Care Compliance: Adherence to screening guidelines

- ROI: $3-4 saved for every $1 spent on prevention

- Target compliance rate: 75-80% of eligible patients

Operational Efficiency Metrics

- Staff Time Savings: Automation of administrative tasks

- 3-4 hours saved per staff member per day

- Annual savings: $45,000-60,000 per FTE

- Call Center Volume Reduction: Self-service portal utilization

- Cost per call: $5-7

- Target reduction: 30-40% through digital channels

- Revenue Cycle Improvement: Faster payment collection

- Days in A/R reduction: 10-15 days

- Collection rate improvement: 5-8%

Use Case Examples:

Use Case 1: AI-Powered Patient Journey Orchestration A multi-state healthcare system implemented an AI-driven patient engagement platform that used machine learning to predict appointment no-shows while maintaining HIPAA compliance. By analyzing de-identified behavioral data, the system achieved a 31% reduction in missed appointments and improved patient satisfaction scores by 24%.

Use Case 2: Secure Omnichannel Patient Communication A specialty clinic network developed a custom MarTech stack integrating their EMR system with HIPAA-compliant marketing automation tools. The solution used natural language processing to analyze patient communications while maintaining strict data segregation. Results included a 42% increase in patient portal adoption and a 28% improvement in medication adherence.

The transition from healthcare's stringent privacy requirements to finance's security-first approach reveals another layer of complexity in regulated MarTech implementations.

Finance MarTech: Navigating the Security-Compliance Matrix

Financial services operate under perhaps the most complex web of regulations, where marketing innovation must balance against stringent security requirements. The average cost of non-compliance in financial services reached $14.82 million in 2023, making regulatory adherence a top priority.

Typical Financial Services MarTech Stack Components:

- Enterprise-grade CRM with audit trails (Salesforce Financial Services Cloud)

- Compliance-focused marketing automation (Marketo with compliance modules)

- Secure data management platforms (Adobe Experience Platform)

- Risk assessment and monitoring tools (Quantifind, ComplyAdvantage)

- Digital asset management with compliance workflows (Bynder, Aprimo)

Key Regulatory Considerations:

Financial Industry Regulations

- Sarbanes-Oxley Act (SOX)

- Section 404: Internal control requirements

- Data retention policies (7 years minimum)

- Audit trail requirements for all customer interactions

- CEO/CFO certification of financial reporting accuracy

- Gramm-Leach-Bliley Act (GLBA)

- Privacy notices to customers

- Opt-out provisions for information sharing

- Safeguards rule for customer data protection

- Pretexting protection requirements

- Dodd-Frank Act

- Consumer Financial Protection Bureau (CFPB) oversight

- Fair lending compliance in marketing

- Truth in advertising requirements

- Whistleblower protections

Payment and Transaction Security

- Payment Card Industry Data Security Standard (PCI DSS)

- 12 requirements for handling cardholder data

- Network security and encryption standards

- Regular security testing requirements

- Access control measures

- Bank Secrecy Act (BSA)

- Anti-money laundering (AML) program requirements

- Suspicious activity reporting

- Customer identification program (CIP)

- Enhanced due diligence for high-risk customers

Investment and Securities Regulations

- FINRA Marketing Rules

- Fair and balanced presentation requirements

- Principal approval for communications

- Record retention requirements (3-6 years)

- Social media compliance guidelines

- SEC Advertising Rules

- Performance advertising restrictions

- Testimonial and endorsement limitations

- Required disclosures and disclaimers

- Books and records requirements

International Financial Regulations

- GDPR for Financial Services

- Explicit consent for data processing

- Right to erasure challenges with AML requirements

- Cross-border data transfer restrictions

- Data protection impact assessments

- MiFID II (EU)

- Marketing communications transparency

- Cost and charges disclosure

- Product governance requirements

- Client categorization rules

AI and Risk Management Integration:

Financial institutions are leveraging AI and machine learning to enhance both marketing effectiveness and compliance. Advanced algorithms can detect potential regulatory violations in marketing content before distribution, while predictive models help identify high-risk customer segments that require additional compliance measures.

ROI in Financial Services:

Customer Acquisition and Retention Metrics

- Customer Acquisition Cost (CAC)

- Retail banking: $200-350 per customer

- Wealth management: $2,000-5,000 per client

- Insurance: $400-700 per policyholder

- Credit cards: $50-200 per cardholder

- Customer Lifetime Value (CLV)

- Retail banking: $3,000-5,000 over 7 years

- Wealth management: $20,000-100,000+ over 10 years

- Insurance: $3,500-8,000 over policy lifetime

- Credit cards: $1,200-2,500 over 5 years

Cross-Sell and Upsell Performance

- Products per Customer (PPC)

- Current average: 2.5 products

- Target: 4+ products per customer

- Revenue increase: 20-30% per additional product

- Cross-Sell Success Rate

- Email campaigns: 2-5% conversion

- Personalized offers: 15-25% conversion

- In-branch/advisor recommendations: 30-40% conversion

Risk and Compliance ROI

- Compliance Cost Reduction

- Manual review costs: $50-100 per piece

- Automated review: $5-10 per piece

- Annual savings: $500,000-2M for mid-size institution

- Fraud Prevention Savings

- Average fraud loss: $3.5M annually

- AI-driven prevention: 40-60% reduction

- False positive reduction: 50-70%

- Regulatory Fine Avoidance

- Average fine: $1-5M per violation

- Compliance automation ROI: 300-500%

- Audit preparation time reduction: 60-75%

Operational Efficiency Gains

- Marketing Operations Cost

- Traditional campaign cost: $15,000-25,000

- Automated campaign cost: $3,000-5,000

- Time to market reduction: 60-80%

- Customer Service Efficiency

- Cost per interaction (human): $6-12

- Cost per interaction (digital): $0.10-0.50

- First contact resolution improvement: 25-35%

Use Case Examples:

Use Case 1: AI-Driven Compliance Monitoring A global bank implemented machine learning algorithms to scan all marketing communications for potential regulatory violations. The system reduced compliance review time by 60% while catching 99.7% of potential issues before distribution, saving an estimated $2.3 million annually in compliance costs.

Use Case 2: Personalization Within Regulatory Boundaries An investment firm developed a custom MarTech solution that used AI to deliver personalized investment recommendations while ensuring compliance with FINRA regulations. The system automatically adjusted messaging based on investor accreditation status, resulting in a 38% increase in qualified leads and zero compliance violations.

While healthcare and finance grapple with consumer protection regulations, B2B organizations face their own unique challenges in managing complex sales cycles and international data privacy requirements.

B2B MarTech: Orchestrating Complex Buyer Journeys

B2B marketing requires sophisticated tools to manage long sales cycles, multiple decision-makers, and complex product offerings. With the average B2B buying group now including 6-10 decision-makers, custom MarTech solutions must handle unprecedented complexity while navigating international data privacy regulations.

Typical B2B MarTech Stack Components:

- ABM platforms (Demandbase, 6sense, Terminus)

- Advanced CRM systems (Salesforce, Microsoft Dynamics)

- Marketing automation (Marketo, HubSpot Enterprise)

- Intent data platforms (Bombora, TechTarget Priority Engine)

- Sales enablement tools (Seismic, Highspot)

- Analytics platforms (Tableau, Power BI)

Key Regulatory Considerations:

Global Privacy Regulations

- General Data Protection Regulation (GDPR)

- Lawful basis for processing (consent, legitimate interest)

- Data subject rights (access, erasure, portability)

- Data protection impact assessments

- Breach notification within 72 hours

- Data protection officer requirements

- California Consumer Privacy Act (CCPA/CPRA)

- "Do Not Sell" opt-out requirements

- Consumer data access rights

- Business-to-business exemption limitations

- Service provider agreement requirements

- Canadian Anti-Spam Legislation (CASL)

- Express consent requirements for commercial emails

- Implied consent limitations and expiration

- Unsubscribe mechanism requirements

- Record-keeping obligations

Industry-Specific B2B Regulations

- ITAR (International Traffic in Arms Regulations)

- Export control compliance for defense industry

- Restricted party screening requirements

- Technology transfer limitations

- Foreign person restrictions

- HIPAA Business Associate Agreements

- Requirements when marketing to healthcare providers

- PHI handling restrictions

- Subcontractor flow-down provisions

- Breach notification obligations

- Financial Services Third-Party Risk

- Vendor due diligence requirements

- Data security standards

- Audit and examination rights

- Incident response coordination

Data Transfer and Localization

- Cross-Border Data Transfer Mechanisms

- EU-US Data Privacy Framework requirements

- Standard Contractual Clauses (SCCs)

- Binding Corporate Rules (BCRs)

- Transfer impact assessments

- Data Localization Requirements

- China Cybersecurity Law

- Russia data localization law

- India Personal Data Protection Bill

- Sector-specific requirements (finance, healthcare)

B2B Email Marketing Compliance

- CAN-SPAM Act Requirements

- Clear sender identification

- Accurate subject lines

- Physical postal address inclusion

- Opt-out mechanism (10-day compliance)

- Industry-Specific Email Rules

- SEC requirements for financial communications

- FDA regulations for pharmaceutical marketing

- FTC guidelines for endorsements and testimonials

- Professional association ethical guidelines

GDPR and Global Privacy Considerations:

B2B organizations operating internationally must navigate a complex web of privacy regulations:

- GDPR compliance for EU operations

- CCPA/CPRA for California-based prospects

- PIPEDA for Canadian business relationships

- Industry-specific regulations (e.g., ITAR for defense contractors)

- Cross-border data transfer requirements

The challenge intensifies when B2B companies market to regulated industries, creating a compliance multiplier effect that standard MarTech solutions rarely address.

ROI in B2B MarTech:

Pipeline and Revenue Metrics

- Marketing Qualified Lead (MQL) to Sales Qualified Lead (SQL) Conversion

- Industry average: 13%

- With proper MarTech: 25-35%

- Value per conversion improvement: $5,000-50,000

- Sales Cycle Length Reduction

- Average B2B cycle: 6-18 months

- MarTech-enabled reduction: 20-30%

- Revenue acceleration impact: 15-25% annually

- Deal Size Increase

- Average deal size lift: 10-30%

- Cross-sell/upsell success: 15-25% of opportunities

- Account expansion rate: 20-40% year-over-year

Account-Based Marketing (ABM) Performance

- Target Account Engagement

- Engagement rate increase: 50-200%

- Account penetration (contacts per account): 3x improvement

- Meeting acceptance rate: 40-60% vs. 10-15% traditional

- ABM Program ROI

- Revenue per target account: 35% higher

- Win rates: 40-50% vs. 20-30% traditional

- Customer lifetime value: 25-50% increase

Marketing Attribution and Efficiency

- Multi-Touch Attribution Accuracy

- First-touch vs. multi-touch variance: 40-60%

- Marketing influence on pipeline: 30-70% of deals

- Channel ROI visibility improvement: 3-5x

- Content Marketing Performance

- Content engagement to opportunity: 5-8%

- Content-influenced deals: 47% of B2B purchases

- Content ROI: $3-5 per $1 spent

Sales and Marketing Alignment

- Lead Response Time

- Current average: 42 hours

- MarTech-enabled: <5 hours

- Conversion impact: 7x higher when <5 minutes

- Sales Acceptance Rate

- Traditional MQL acceptance: 20-30%

- MarTech-qualified leads: 60-80%

- Sales productivity increase: 15-25%

Customer Retention and Expansion

- Customer Retention Rate

- Industry average: 70-80%

- With predictive analytics: 85-95%

- Revenue impact: 25-95% profit increase

- Net Revenue Retention (NRR)

- Target: 110-130%

- Top performers: 140%+

- Expansion revenue: 30-40% of growth

Use Case Examples:

Use Case 1: GDPR-Compliant ABM at Scale A global technology provider built a custom ABM platform that automatically adjusted data collection and marketing tactics based on prospect location and industry. The system maintained separate data processing workflows for EU, US, and APAC regions, resulting in 100% GDPR compliance while increasing engagement rates by 52%.

Use Case 2: Multi-Jurisdiction Intent Data Integration A manufacturing conglomerate developed a MarTech solution that combined first-party data with third-party intent signals while respecting varying privacy laws across 40+ countries. The platform's AI engine predicted buying intent with 76% accuracy while maintaining full compliance with local regulations.

With the complexity of industry-specific requirements established, the question becomes: How do organizations build a business case for these specialized solutions?

Building the Business Case: ROI Frameworks for Niche Industries

When evaluating custom MarTech solutions, organizations must consider both direct and indirect returns:

Direct ROI Factors:

- Increased conversion rates

- Reduced compliance violations and fines

- Improved operational efficiency

- Higher customer lifetime value

- Decreased customer acquisition costs

Indirect ROI Factors:

- Enhanced brand reputation

- Better risk management

- Improved employee productivity

- Stronger competitive positioning

- Reduced legal exposure

Total Cost of Ownership (TCO) Considerations:

- Initial implementation costs

- Ongoing maintenance and updates

- Training and change management

- Compliance monitoring and auditing

- Integration with existing systems

Best Practices for Implementation

Successfully implementing industry-specific MarTech requires a strategic, methodical approach that balances technical requirements with regulatory compliance and organizational change management. The foundation of any successful implementation begins with cross-functional team formation and governance. Essential team members must include marketing leadership, legal and compliance officers, IT security architects, data privacy officers, risk management specialists, and business unit representatives. This diverse team should operate under a formal governance structure with an executive-sponsored steering committee, specialized working groups for regulatory areas, and clearly defined decision-making protocols. The team's first priority should be creating a comprehensive project charter that outlines objectives, constraints, and KPIs aligned with both business and compliance goals.

A compliance-by-design architecture forms the technical backbone of any regulated MarTech implementation. This approach requires building privacy and security into every aspect of the system from the ground up, incorporating data classification systems, role-based access controls, encryption protocols, and comprehensive audit logging capabilities. The architecture must adhere to fundamental principles like privacy by default, data minimization, and purpose limitation while ensuring geographic data residency compliance and robust API security standards. Before any development begins, teams should conduct thorough regulatory gap analyses, map data flows across systems, and design automated compliance checkpoints that will serve as guardrails throughout the implementation process.

The implementation itself should follow a carefully planned phased approach to minimize risk and ensure proper validation at each stage. The foundation phase, typically lasting three months, focuses on documenting regulatory requirements, designing the technical architecture, selecting vendors, and planning pilot programs. The core implementation phase follows over the next six months, encompassing platform configuration, system integration, compliance control implementation, and extensive user acceptance testing. The final rollout phase involves staged deployment by region or department, continuous performance monitoring, compliance validation, and optimization based on real-world usage patterns.

Data migration and integration represent critical challenges that require meticulous planning and execution. Organizations must begin with a comprehensive assessment of all data sources, classifying information by sensitivity level and identifying quality issues that could impact compliance. The migration approach should utilize ETL tools with built-in compliance features, implement multiple validation checkpoints, and maintain parallel systems during transition to ensure business continuity. Integration strategies should favor API-first approaches with middleware solutions for complex scenarios, ensuring real-time data synchronization while maintaining detailed documentation of all integration points.

Continuous compliance monitoring and audit preparation form an essential ongoing practice in regulated MarTech environments. Organizations must implement automated compliance scanning tools, real-time alert systems for potential violations, and regular vulnerability assessments. The audit framework should maintain comprehensive trails of all system activities, document compliance decisions, and create evidence repositories that can quickly respond to regulatory inquiries. This proactive approach should be supported by a structured reporting hierarchy that includes daily operational reports, weekly compliance summaries, and quarterly risk assessments.

Change management and training programs are crucial for ensuring user adoption and maintaining compliance across the organization. Training must be role-specific, incorporating compliance awareness, technical skills development, and scenario-based learning that prepares users for real-world situations. The change management strategy should include comprehensive stakeholder communication plans, resistance management approaches, and continuous feedback mechanisms that allow for iterative improvements. All training and procedures must be supported by detailed documentation including user manuals, compliance procedures, technical specifications, and best practice libraries.

Vendor management requires rigorous assessment frameworks that evaluate potential partners based on industry-specific experience, compliance certifications, data residency capabilities, and security track records. Contract negotiations must address critical issues including data ownership, compliance responsibility matrices, breach notification requirements, and detailed service level agreements. Organizations should also develop comprehensive exit strategies that ensure business continuity even if vendor relationships change.

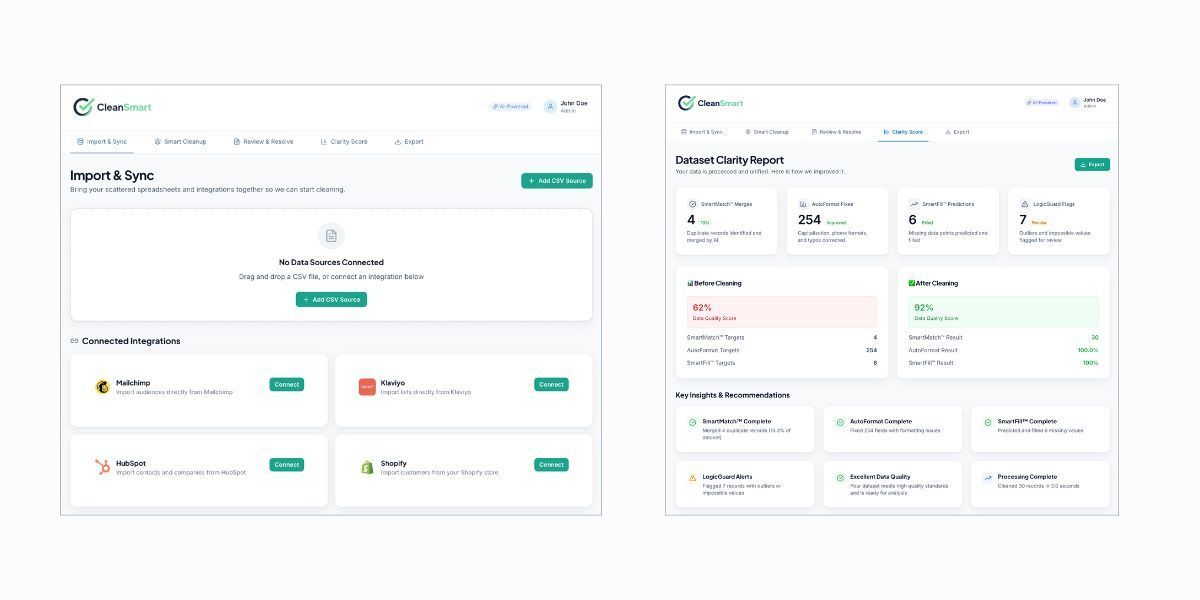

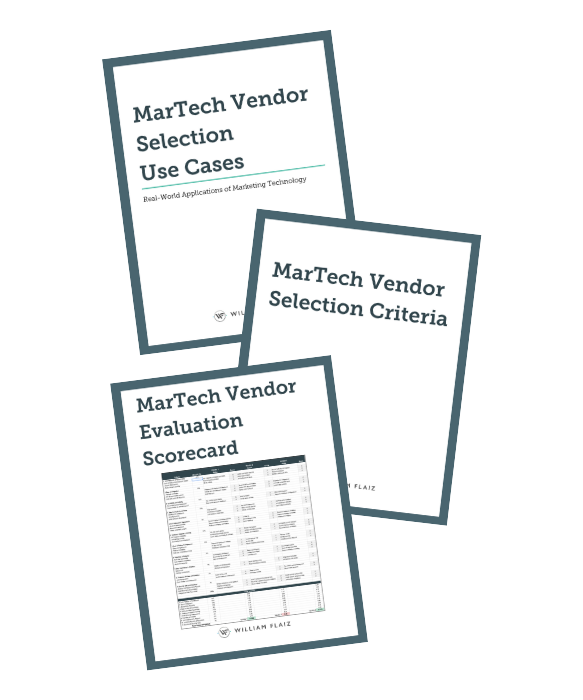

Don’t risk your next MarTech investment on gut instinct or vendor hype.

Get the Vendor Evaluation Toolkit—a proven, repeatable system designed from 50+ enterprise selections. Whether you’re choosing a CDP, CRM, or marketing automation platform, this three-part framework gives you the clarity, structure, and confidence to make smarter decisions.

Explore the Toolkit Now and start transforming how your team selects MarTech solutions.

Future-proofing and scalability planning ensure that MarTech investments remain valuable as regulations and business needs evolve. This requires adopting modular architectures, API-first development approaches, and cloud-native capabilities that can easily adapt to changing requirements. Regulatory adaptability should be built into the system through flexible compliance frameworks, configurable rule engines, and automated update mechanisms that can quickly incorporate new regulatory requirements.

Success measurement and ROI tracking require establishing clear performance indicators that encompass compliance violation rates, implementation timeline adherence, user adoption metrics, and direct financial impacts. Organizations should develop comprehensive ROI calculation frameworks that consider both direct cost savings and indirect benefits like risk reduction and efficiency improvements. These metrics should feed into continuous improvement processes that regularly review performance, incorporate feedback, and drive technology refresh cycles.

Finally, crisis management and incident response planning provide essential safeguards for when things go wrong. Organizations must develop detailed incident response plans with clear classification systems, response team activation protocols, and communication templates. Business continuity planning should include disaster recovery procedures, failover mechanisms, and clearly defined recovery time objectives that ensure minimal disruption to operations.

By following these comprehensive best practices, organizations can significantly increase their chances of successful MarTech implementation while maintaining regulatory compliance and achieving desired business outcomes. The key lies in treating implementation not as a technical project but as a business transformation initiative that requires careful planning, cross-functional collaboration, and continuous adaptation to changing regulatory landscapes.

The Future is Composable

As regulatory landscapes continue to evolve and customer expectations grow more sophisticated, the future of industry-specific MarTech lies in composable architectures. These modular, API-first solutions allow organizations to swap components as regulations change, without overhauling their entire stack.

Composable MarTech stacks offer several advantages for regulated industries:

- Rapid adaptation to new compliance requirements

- Best-of-breed solutions for specific functions

- Reduced vendor lock-in

- Easier integration with legacy systems

- Lower total cost of ownership over time

Organizations that embrace composable, industry-specific MarTech solutions today position themselves for sustainable growth while minimizing compliance risks. The question isn't whether to customize your MarTech stack—it's how quickly you can adapt to meet your industry's unique demands.

Ready to transform your MarTech approach? Start by assessing your current stack against industry-specific requirements and identifying gaps where custom solutions could drive measurable impact.

How long does it typically take to implement a custom MarTech solution for regulated industries?

Implementation timelines vary based on complexity, but most custom MarTech solutions for regulated industries take 6-18 months from planning to full deployment. This includes compliance review, integration testing, and user training phases.

What's the average ROI timeline for industry-specific MarTech investments?

Organizations typically see initial returns within 12-18 months, with full ROI realized in 24-36 months. However, compliance-related savings and risk reduction benefits begin immediately upon implementation.

Can existing MarTech tools be modified for regulatory compliance, or is complete replacement necessary?

Many existing tools can be modified with custom integrations and compliance layers. The decision depends on the tool's architecture, API capabilities, and the specific regulatory requirements of your industry.

Author: William Flaiz