AI Audience Segmentation for B2B: The Software Selection Guide

You're searching for AI segmentation software because your current approach isn't working. Maybe you're still slicing audiences by industry and company size. Maybe your "personalized" campaigns go to segments of 50,000 people who share nothing except a job title.

The tools exist to fix this. The question is which one fits your situation.

I've implemented segmentation platforms at organizations ranging from scrappy startups to Fortune 500 pharmaceutical companies. The pattern I see repeatedly: teams buy software that's two tiers above or below what they need, then blame the technology when results disappoint.

This guide helps you avoid that trap.

The B2B Segmentation Software Landscape

The market splits into three categories based on what problem you're solving:

Data Enrichment Platforms fill gaps in your existing records. You have email addresses and company names; they add firmographics, technographics, and intent signals. Clearbit (now Breeze Intelligence through HubSpot), ZoomInfo, and Cognism live here.

Customer Data Platforms (CDPs) unify behavioral data across touchpoints and create segments based on actions, not just attributes. Segment, mParticle, and Tealium anchor this category.

Account-Based Marketing Platforms combine enrichment, intent data, and advertising orchestration for targeted account engagement. 6sense and Demandbase dominate enterprise ABM.

Most B2B teams need capabilities from multiple categories. The question is whether you buy an all-in-one platform or assemble best-of-breed tools.

Software Comparison by Budget Tier

| Tool | Best For | Annual Cost | Minimum Data Needed | Key Strength |

|---|---|---|---|---|

| HubSpot | SMB starting out | $800-$3,600 | Basic CRM data | Native CRM integration |

| Apollo.io | Prospecting + enrichment | $600-$1,200/user | Email list | Affordable enrichment |

| Usermaven | Product-led SaaS | $588-$1,200 | Product usage data | No-code behavioral tracking |

| Clearbit/Breeze | HubSpot users | $12,000-$80,000 | 1,000+ contacts | Real-time enrichment |

| Segment | Multi-product companies | $12,000-$120,000 | Multiple data sources | Identity resolution |

| Cognism | EMEA-focused teams | $15,000+ | Outbound focus | GDPR compliance |

| 6sense | Enterprise ABM | $40,000-$100,000 | 10,000+ accounts | Predictive intent |

| Demandbase | ABM + advertising | $50,000-$120,000 | Existing ABM motion | Integrated DSP |

The pricing varies wildly based on contact volume, modules purchased, and negotiation. These ranges reflect what I've seen in actual implementations.

Related: Building the Ultimate MarTech Stack: Essential Tools for 2025

Selection Framework by Company Stage

Startups and SMBs (Under $10M Revenue)

You probably don't need a dedicated segmentation platform yet. Start with your CRM's native segmentation (HubSpot's Smart Lists, Salesforce's dynamic reports) and prove the business case before investing.

When to upgrade: When you're sending the same message to prospects at different buying stages because you can't tell them apart.

Recommended stack: HubSpot or Apollo.io for enrichment, Google Analytics 4 for behavioral data, manual segment creation until you hit 5,000+ contacts.

Mid-Market ($10M-$100M Revenue)

This is where segmentation software starts paying for itself. You have enough data to train models and enough revenue at stake to justify the investment.

When to upgrade: When your sales team complains about lead quality, or when campaigns plateau despite increased spend.

Recommended stack: Clearbit/Breeze Intelligence for enrichment plus Segment for behavioral unification if you run multiple products. Budget $20,000-$50,000 annually.

Enterprise ($100M+ Revenue)

You need predictive capabilities, not just descriptive segments. The ROI math changes when a single enterprise deal covers your annual software cost.

When to upgrade: When you're running ABM but can't predict which accounts will convert this quarter versus next year.

Recommended stack: 6sense or Demandbase for the full ABM motion, or Clearbit + Bombora for intent data without the advertising lock-in. Budget $50,000-$150,000 annually.

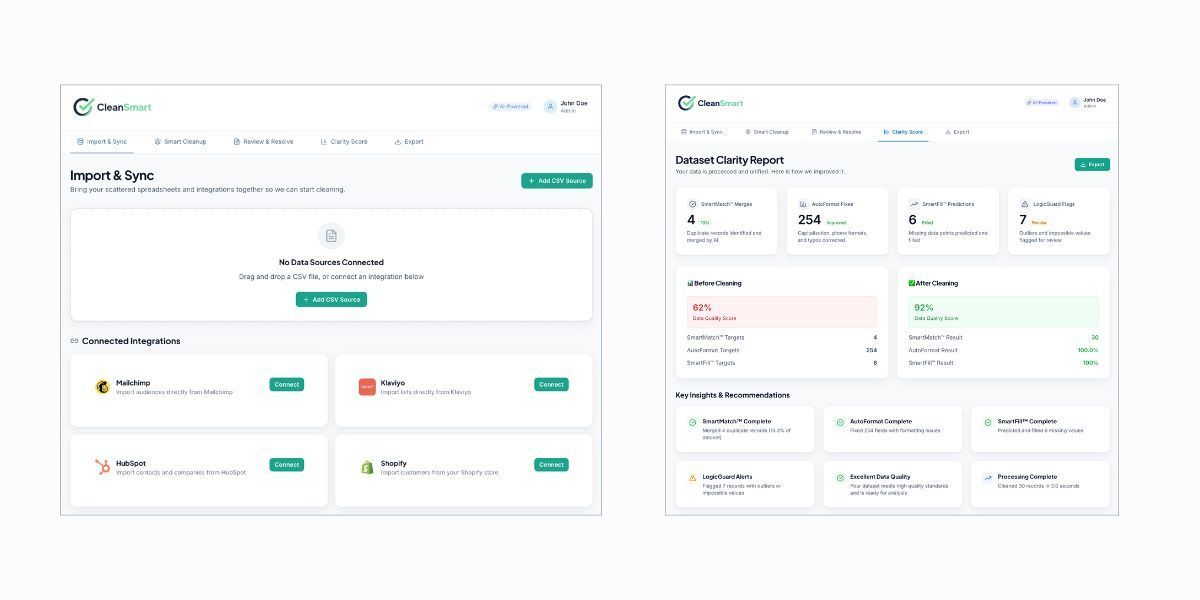

The Data Foundation Most Buyers Skip

Here's the uncomfortable truth: 80% of segmentation failures trace back to data quality, not software limitations.

I worked with an e-commerce platform that had 500,000 email contacts. Sounded impressive until we audited the list. Duplicates, outdated records, missing fields. The "clean" portion was closer to 200,000.

We spent eight weeks on data hygiene before touching segmentation software. The result? A million-dollar revenue stream from email within eight months. Not because we bought better technology, but because we fixed the foundation first.

Download: MarTech Data Cleanliness Checklist

Before evaluating any platform, answer these questions:

- What percentage of your CRM records have complete firmographic data? If it's below 60%, start with enrichment before segmentation.

- Can you track individual behavior across your website, email, and product? If not, a CDP should come before an ABM platform.

- How many data sources feed your customer view? If it's more than three, you need identity resolution before advanced segmentation.

What Behavioral Segmentation Produces

The shift from static demographics to behavioral segmentation changes what's possible.

At a healthcare company, we built propensity models that predicted patient engagement based on touchpoint patterns. The models feed personalized outreach sequences. Each percentage point improvement in engagement translates to roughly $10M in medical margin. Traditional demographic segmentation couldn't identify these patterns because the signals were behavioral, not categorical.

For a product review platform, we implemented dynamic segmentation through Cordial based on browsing behavior, purchase history, and content consumption. Revenue per user climbed steadily as the system learned which products to recommend to which behavioral clusters.

The common thread: behavioral data beats demographic data for predicting what someone will do next.

Related: From Data to Action: The Role of AI in Optimizing MarTech Stacks

Platform Evaluation Criteria

When comparing tools, weight these factors based on your situation:

Integration Depth

Does it connect natively to your CRM and marketing automation? A platform that requires CSV exports and manual uploads will never achieve real-time segmentation.

Test this: Ask for a demo using your actual tech stack, not a generic integration list.

Enrichment Sources

Where does the platform source its data? First-party behavioral data you collect will always be more accurate than third-party data they purchase.

Test this: Enrich 100 of your existing contacts and manually verify accuracy on 10.

Segment Portability

Can you push segments to advertising platforms, email tools, and sales systems? A segment that only lives in one platform creates silos.

Test this: Export a test segment to your ad platform and measure match rates.

Model Transparency

Does the platform explain why contacts land in specific segments? Black-box algorithms create adoption problems when sales teams don't trust the categorizations.

Test this: Ask the vendor to explain the logic behind a sample segment in plain language.

Related: The Hidden Costs of MarTech: How to Reduce Waste and Improve ROI

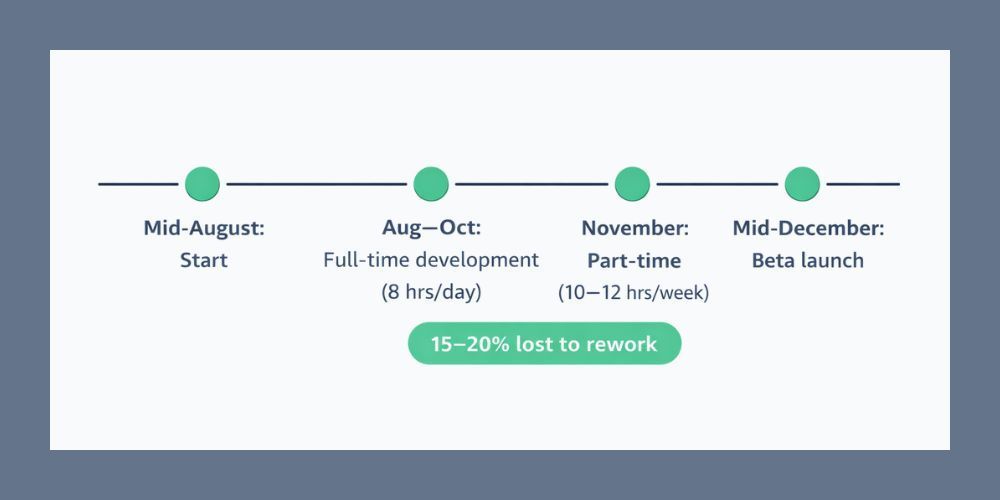

Implementation Timeline Expectations

Realistic timelines based on what I've seen work:

- Basic enrichment (Clearbit, Apollo): 2-4 weeks to full deployment. These are relatively plug-and-play with standard CRM integrations.

- CDP implementation (Segment, mParticle): 2-4 months for proper identity resolution. You're unifying data sources, which surfaces all your data quality issues.

- Full ABM platform (6sense, Demandbase): 4-6 months to see predictive value. The models need historical data to train, and your team needs to trust the outputs before acting on them.

- ROI timeline: Expect 90-180 days before you can measure the impact of segmentation changes. The exception is obvious data quality improvements, which often show immediate email deliverability gains.

The Build vs. Buy Consideration

Some organizations build custom segmentation on top of their data warehouse. This makes sense when:

- You have data engineering resources available

- Your segmentation logic is highly specific to your business

- You're already running Databricks, Snowflake, or BigQuery

- You want to own the intellectual property

At one healthcare company, we built a custom lakehouse architecture with Unity Catalog as the metadata backbone. The gold layer feeds propensity models for patient outreach. This approach made sense because the segmentation logic itself was the competitive advantage, not the platform.

For most organizations, buying makes more sense. The implementation cost of building custom segmentation typically exceeds three years of platform licensing, and you're competing with vendors who have hundreds of engineers focused on this problem.

Making the Final Decision

The selection process that works:

- Define your primary use case. Account prioritization? Campaign personalization? Churn prediction? The answer determines which category of tool you need.

- Audit your data foundation. If enrichment gaps or quality issues exist, solve those first.

- Request pilots with your data. Generic demos tell you nothing. Run 30-day pilots with your actual contacts and measure segment accuracy.

- Calculate total cost of ownership. Include implementation services, ongoing data credits, and internal resources for maintenance.

- Talk to customers at your scale. A platform that works for a 10,000-contact database may collapse at 500,000.

The right tool is the one that matches your data maturity, budget, and primary use case. More expensive doesn't mean better. More features doesn't mean better fit.

Start with the foundation, pick the tool that solves your specific problem, and resist the temptation to buy capabilities you won't use for two years.

How much CRM data do we need before AI segmentation becomes useful?

For basic enrichment and firmographic segmentation, 1,000+ contacts is sufficient. For predictive models like propensity scoring or churn prediction, you need 6+ months of behavioral history and ideally 200+ conversion events to train against. Start with descriptive segmentation and graduate to predictive as your data matures.

Can AI segmentation tools integrate with our existing CRM?

Most platforms offer native integrations with Salesforce, HubSpot, and Microsoft Dynamics. The real question is integration depth. Surface-level integrations sync contact lists; deep integrations enable bi-directional data flow, real-time segment updates, and triggered workflows. During evaluation, test actual integration functionality rather than checking a box on a feature list.

What's the typical ROI timeline for B2B segmentation software?

Basic enrichment improvements (email deliverability, lead routing accuracy) show results within 30-60 days. Campaign performance improvements from behavioral segmentation typically appear in 3-4 months. Full predictive capabilities like account prioritization and intent-based targeting require 6-12 months to mature as models train on outcomes. Plan for 12 months to reach steady-state ROI.

Author: William Flaiz