Digital Debt Is Killing Your Marketing Budget — Here's How to Calculate the Real Cost

Imagine this: Your marketing team pours hours into crafting campaigns, only to watch conversions stall because outdated websites load slowly, fragmented tools duplicate efforts, and forgotten digital assets rack up hidden fees. Meanwhile, your budget shrinks under the weight of maintenance costs that nobody saw coming. This isn't just inefficiency—it's a crisis that's quietly eroding your resources, and if left unchecked, it could doom your growth plans before they even launch.

I've seen this play out firsthand in global enterprises, where unchecked digital sprawl turned promising strategies into budget black holes. At Novartis, we faced over 1,200 disparate websites across 90 countries, each demanding separate upkeep and compliance checks. The result? Skyrocketing costs and compliance risks that threatened to derail our international web strategy. But by confronting this "digital debt," we consolidated those sites, slashing operating costs by 52% and paving the way for a more agile, customer-focused ecosystem. If you're in marketing leadership, this story isn't unique—it's a warning. Let's break down what digital debt really means and how it's sabotaging your budget right now.

What Exactly Is Digital Debt?

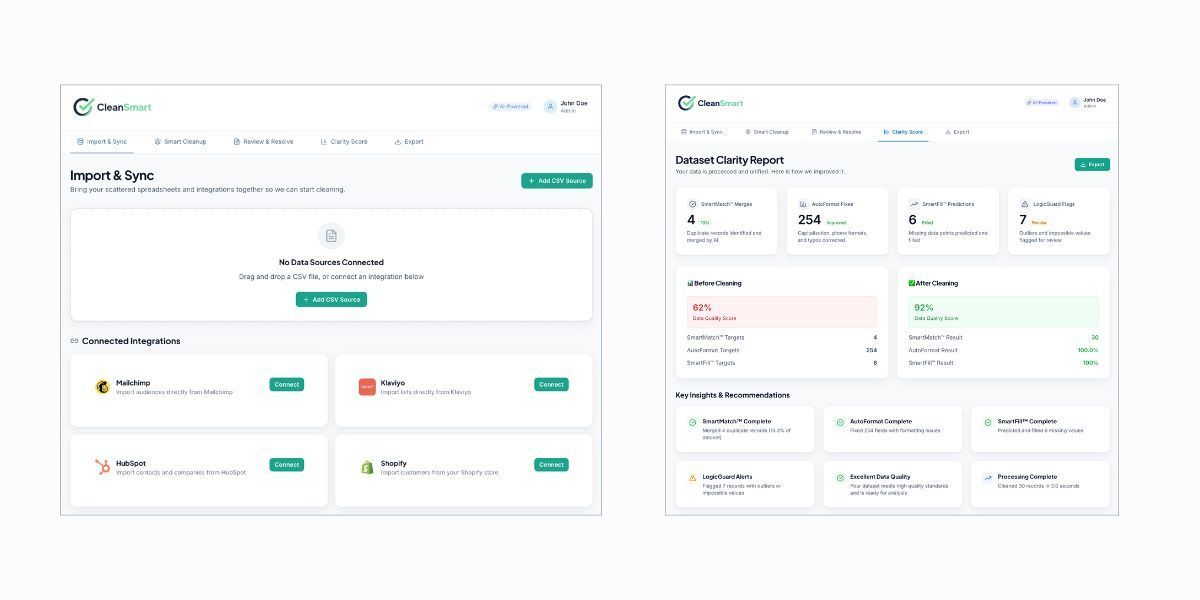

Digital debt accumulates like technical debt in software development, but it hits marketing harder because it spans tools, platforms, and processes that directly touch customer experiences. Think of it as the legacy of quick fixes and rapid expansions: abandoned landing pages from past campaigns, overlapping MarTech tools that don't integrate well, or outdated content management systems that require constant patches.

In my consulting work with Citi Bank UK, their fragmented MarTech platforms created silos where data flowed inefficiently, leading to duplicated customer outreach and wasted ad spend. Digital debt isn't just about old tech—it's the ongoing drag from misaligned processes, like manual data entry across non-integrated systems or redundant vendor contracts that pile up over years.

Forward-thinking leaders recognize this as more than a nuisance; it's a barrier to innovation. In regulated industries like healthcare and finance, where I've led transformations, digital debt amplifies risks—non-compliant sites can lead to fines, while poor integration hampers personalization, leaving customers frustrated and competitors ahead.

How Digital Debt Accumulates and Eats Away at Your Resources

Digital debt builds silently through layers of decisions made in isolation. Start with expansion: As your company grows, teams add new tools— a CRM here, an analytics platform there—without a unified architecture. Over time, these create "debt interest" in the form of integration workarounds, training gaps, and security vulnerabilities.

Consider the cost accumulation cycle:

- Initial Acquisition Costs: You invest in a shiny new tool, say a marketing automation platform, expecting quick wins. But without proper integration, it sits alongside existing systems, doubling your subscription fees.

- Maintenance Overhead: Each asset requires updates, hosting, and monitoring. In my Novartis project, managing 1,200+ sites meant scattered teams handling patches, leading to a 30% maintenance overhead before consolidation.

- Opportunity Losses: Time spent firefighting legacy issues steals from innovation. At Bottom Line Strategy Group, where I directed MarTech strategies for healthcare clients, fragmented tools delayed campaign launches, costing weeks in lost revenue potential.

- Hidden Multipliers: Compliance in global operations adds layers—think GDPR audits for European sites or HIPAA checks in healthcare. These aren't one-offs; they recur, compounding the debt.

Real-world data backs this: Studies show enterprises waste up to 40% of their tech budgets on maintaining outdated systems. In my experience scaling MarTech ecosystems from $1M to $50M+ in revenue, I've seen how this accumulation turns efficient operations into bloated ones, where every new initiative starts from a deficit.

Quantifying the Efficiency Drain: Real Numbers from the Trenches

To inspire action, let's attach numbers to the pain. Digital debt doesn't just feel expensive—it is. At Novartis, our audit revealed that unmanaged sites exposed us to major legal risks while inflating costs. Post-consolidation, we projected a 30% drop in maintenance, freeing budget for data-driven personalization that boosted engagement.

Efficiency drains show up in key metrics:

- Productivity Loss: Teams spend 20-30% more time on manual tasks due to poor integration. In my engagement with a client in education, migrating to Pardot from a fragmented setup increased lead quality and closed deals by 5-7% monthly.

- ROI Erosion: MarTech stacks with high debt deliver lower returns. For instance, at a product review company, optimizing SEO and email personalization amid legacy issues yielded a 28% traffic revenue boost—but only after addressing the debt.

- Budget Bloat: Calculate it broadly: If your annual marketing budget is $5M, and 25% goes to maintaining redundant assets (a conservative estimate from my Fortune 100 experiences), that's $1.25M vanished annually.

These aren't abstract; they're measurable drags that forward-looking strategies can reverse. By quantifying them, you shift from reactive spending to visionary allocation, where every dollar fuels growth.

A Step-by-Step Framework to Calculate Your Digital Debt's Real Cost

Simplifying complexity is key here—technical audiences appreciate the math, while non-technical ones need actionable steps. Here's a practical framework I've used in consultations, drawing from my Novartis consolidation and Citi Bank optimizations. It combines direct costs, indirect impacts, and future projections.

- Inventory Your Digital Assets:

- List all websites, tools, platforms, and processes. Include CRMs, CDPs, analytics dashboards, and even forgotten microsites.

- Track Direct Costs:

- Sum subscriptions, hosting, and vendor fees. Add personnel time for maintenance (e.g., hours/week x hourly rate).

- Formula: Annual Direct Cost = (Subscriptions + Hosting + Patches) + (Maintenance Hours x Team Rate).

- Measure Indirect Costs:

- Quantify productivity hits: Survey teams on time lost to workarounds, then multiply by salary rates.

- Include opportunity costs: Lost revenue from delayed campaigns (e.g., average campaign ROI x delay weeks).

- Formula: Indirect Cost = (Productivity Loss Hours x Rate) + (Opportunity Loss + Compliance Risks).

- Project Future Impact:

- Estimate escalation: If unaddressed, costs compound at 10-20% yearly due to tech evolution.

- Net Digital Debt = Direct + Indirect + (Future Escalation x Years).

- Calculate Total ROI Impact:

- Compare current efficiency to benchmarks. If your stack should deliver 3.5X ROI (as in my Formative CRM implementation), subtract debt drag to find the gap.

- Total Cost = Net Digital Debt / Budget Percentage.

Run this quarterly. In my AI-driven consumer research platform for backpack markets, similar analytics revealed sentiment trends that could prevent debt by spotting inefficiencies early—adapt it for your MarTech.

Strategies to Optimize Your Budget and Break Free from Digital Debt

Visionary transformation starts with strategy. Once calculated, tackle debt head-on:

- Consolidate Ruthlessly: Mirror my Novartis approach—audit and retire redundancies. Aim for a unified platform reducing sites by 75%, as we did.

- Integrate Smartly: Build architectures that connect CRM, automation, and analytics. At INRIX, Salesforce-Pardot integration lifted close rates from 6% to 17%.

- Govern Proactively: Establish review processes, like bi-weekly stakeholder checks I implemented at Novartis, to catch issues early.

- Measure and Iterate: Track post-optimization metrics—expect 20-50% cost savings, as seen in my CT3 consolidation (27% reduction).

These steps not only reclaim budget but position you for AI-enhanced personalization and scalable growth.

What is digital debt, and why does it matter for marketing teams?

Digital debt refers to the accumulated inefficiencies from outdated or fragmented MarTech tools, websites, and processes that drain resources over time. It matters because it can consume up to 40% of your budget on maintenance, reducing funds for innovation and customer-focused campaigns, as seen in my Novartis consolidation where we cut costs by 52%.

How can I quickly estimate my organization's digital debt without a full audit?

Start with a high-level inventory of your top 10-20 digital assets and track their direct costs like subscriptions and maintenance hours. Use the formula: Direct Cost + (Productivity Loss x Team Rate) for a baseline. In my experience with Citi Bank, this initial scan revealed quick wins that streamlined data flows and boosted ROI.

What are the first steps to reduce digital debt after calculating it?

Prioritize consolidation by auditing redundancies and retiring low-value assets, then integrate remaining tools for seamless data flow. Implement governance like bi-weekly reviews, as I did at Novartis, to prevent future buildup. This approach can yield 20-50% savings, freeing budget for AI-driven personalization.

Author: William Flaiz