Legacy System Assessment: The Fortune 500 Framework for Cutting $67M in Hidden Costs

A Fortune 500 audit uncovered $67M in annual waste hiding inside 1,247 websites. The fix cost a third of maintaining the mess.

The CFO's email landed like a grenade: "Why are we spending $47M annually on websites that generate less traffic than our intern's TikTok account?"

Fair question. Brutal delivery.

I was six months deep into auditing a Fortune 500 company's digital ecosystem when we uncovered the wreckage. Of their 1,247 websites, close to 800 hadn't been touched in over two years. Some ran on platforms so outdated that security patches no longer existed. One critical business application was held together by code written during the Obama administration.

This wasn't technical debt. This was technical bankruptcy.

The Compound Interest Nobody Talks About

Most executives understand legacy tech debt in the abstract. Older systems need maintenance. Updates slow down. Security gaps widen. Standard stuff.

What catches them off guard is how digital neglect compounds. Not linearly. Exponentially.

Here's what surfaced during that audit:

The line items everyone sees:

- $12.3M in redundant licensing fees spread across 23 overlapping platforms

- $8.7M in maintenance contracts for systems serving fewer than 50 users each

- $4.2M in compliance remediation for platforms that couldn't meet current regulatory requirements

The costs nobody tracks:

- 73% longer time-to-market for new digital initiatives because of integration spaghetti

- $18M in opportunity cost from delayed product launches

- 34% higher cybersecurity insurance premiums tied directly to legacy system vulnerabilities

The total: $67M annually in costs attributable to accumulated technical debt.

But here's the number that made the CFO's jaw drop. Building a unified, modern platform from scratch? $23M. And it would cut ongoing operational costs by 52%.

The cleanup wasn't an expense. It was the cheapest option on the table.

Why Legacy Systems Become Financial Vampires

Tech debt doesn't pile up at a steady rate. It spirals. I've watched this pattern repeat across dozens of enterprise environments, and it follows a disturbingly predictable arc:

Year 1: Platform works fine. Minor maintenance. Everyone's happy.

Year 3: Integration headaches start multiplying. Workarounds appear. They're "temporary."

Year 5: Security patches become urgent. Performance tanks. The workarounds are now permanent infrastructure.

Year 7: The platform is unmaintainable. A complete overhaul is the only path forward, and it costs 3-4x what it would have cost to address at Year 3.

This is where the 4:1 ratio comes from. Every dollar of maintenance you defer today will cost roughly four dollars when you're forced to address it later. I've seen this hold true across pharmaceutical companies, financial services firms, and consumer goods manufacturers.

During my time at Novartis, we discovered that 60% of the IT budget was consumed by maintaining systems that supported less than 15% of actual business value. The math pointed in one direction: consolidation wasn't optional, it was financial survival.

The Legacy System Assessment Framework

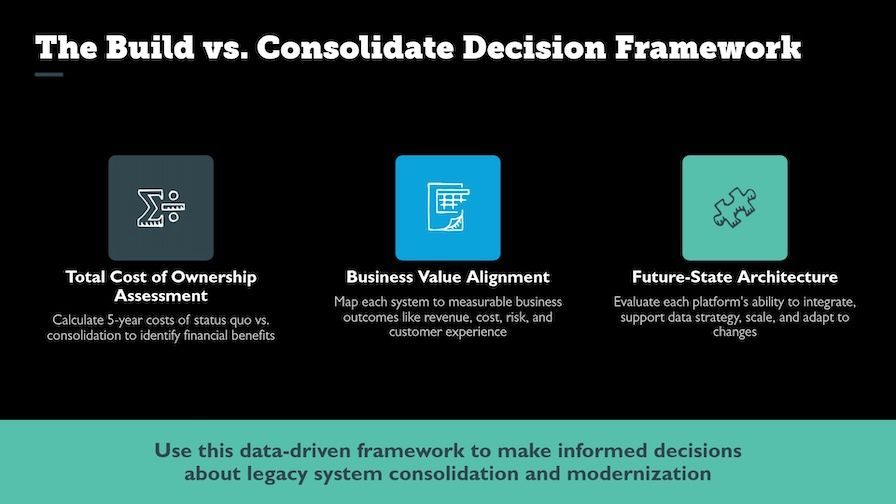

After running these audits for Fortune 500 companies across pharma, financial services, and consumer goods, I've distilled the evaluation into three assessments that CFOs and CTOs can run without hiring a consulting army.

Assessment 1: Total Cost of Ownership (TCO) Calculator

Most organizations massively undercount what their legacy systems cost because they only track direct line items. Here's the full picture:

Status Quo Costs (5-Year Projection)

- Direct maintenance and licensing fees

- Integration and compatibility overhead (developer hours spent on workarounds)

- Security and compliance remediation

- Opportunity cost of delayed initiatives (this is usually the largest number)

- Risk-adjusted cost of potential failures (breach liability, downtime revenue loss)

Consolidation Costs (One-Time + Transition)

- Migration and integration effort

- Data cleanup and standardization

- Training and change management

- Temporary system redundancy during transition

The decision rule: If consolidation costs less than two years of status quo spending, you're losing money every quarter you wait. In my experience across 12+ enterprise engagements, the payback period is typically 14-18 months.

Assessment 2: Business Value Alignment Score

Map every system in your portfolio to measurable business outcomes:

- Revenue generation (direct or supporting)

- Cost reduction capability

- Risk mitigation function

- Customer experience impact

- Compliance requirements

Score each on a 1-5 scale. Any system scoring below 10 total across these five dimensions is a consolidation candidate. When we ran this at Novartis across 1,200+ websites, roughly 75% scored below the threshold. That's not unusual for enterprises that have grown through acquisition or decentralized digital strategies.

Assessment 3: Future-State Architecture Fit

Four questions. If any answer is "no," start planning the retirement:

- Can this platform integrate with modern API-first ecosystems?

- Does it support your data strategy and governance requirements?

- Will it scale with projected business growth over 3-5 years?

- Can it adapt to evolving regulatory requirements without custom development?

The beauty of this framework is that it removes emotion from the conversation. People get attached to systems. Numbers don't care about attachments.

Consolidation ROI: Three Case Studies

The pharmaceutical audit I described isn't an outlier. Here's what consolidation delivered across three different industries:

Global Financial Services Firm

- Before: 89 customer-facing applications, $31M annual costs

- After: 12 integrated platforms, $14M annual costs

- ROI: 187% over three years

Healthcare Technology Company

- Before: 156 internal tools, 18-month average project timelines

- After: 23 core platforms, 6-week average project timelines

- Result: 300% faster time-to-market

Consumer Goods Manufacturer

- Before: 234 marketing websites, 67% duplicate functionality

- After: 31 purpose-built sites, 94% improvement in conversion rates

- Revenue impact: $43M additional sales in year one

The pattern is consistent. Consolidation delivers immediate cost savings and compounds into long-term competitive advantage. The companies that delay aren't saving money. They're borrowing against their own future at terrible interest rates.

The Four-Phase Cleanup Playbook

If you're sitting on a legacy mess and feeling overwhelmed, here's the sequence I've used across digital transformation engagements at every scale:

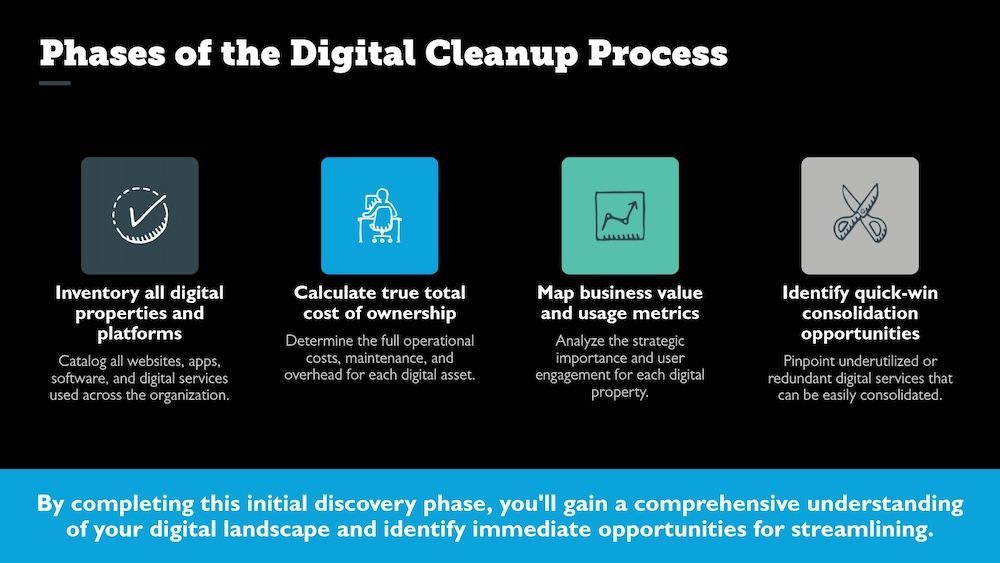

Phase 1: Discovery (Weeks 1-4)

Inventory every digital property and platform. Calculate true total cost of ownership using the TCO framework above. Map business value scores. Identify the quick wins, the systems with fewer than 100 active users and no critical integrations. Those are your practice rounds.

Phase 2: Strategic Planning (Weeks 5-8)

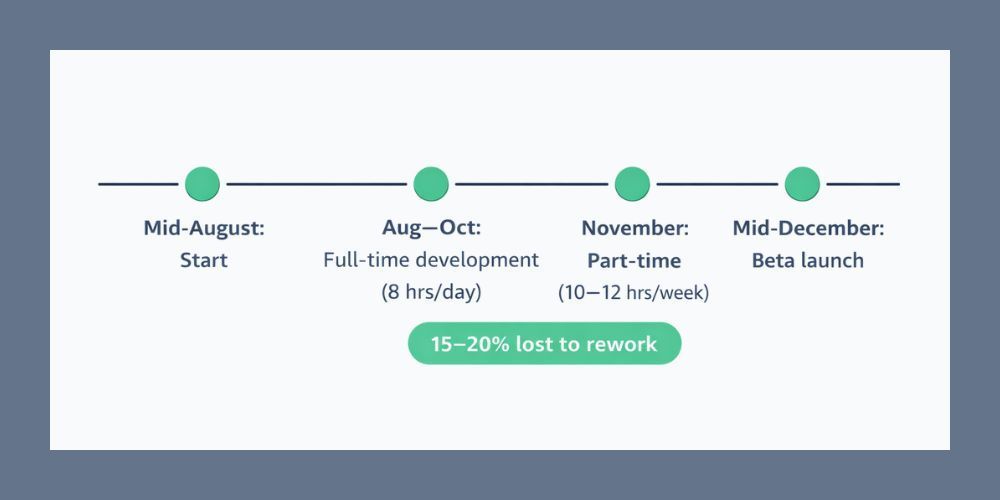

Design the target-state architecture. Prioritize consolidation initiatives by ROI, not by what's easiest or most politically convenient. Develop migration and sunset strategies. Build stakeholder alignment. This last piece matters more than most people expect. I brought legal, regulatory, compliance, medical affairs, and patient services into the process from day one at Novartis, which was unusual there but prevented late-stage surprises that would have required expensive rework.

Phase 3: Execution (Months 3-12)

Start with the highest-impact, lowest-risk consolidations. Run parallel systems for 30-90 days before cutting over. Migrate non-critical functions first. Maintain rollback capability for six months post-migration. At Novartis, we consolidated 900+ websites with zero business disruption by treating each migration as a surgical procedure, not a wholesale replacement.

Phase 4: Governance (Ongoing)

Establish rules that prevent future sprawl. Run regular portfolio reviews. Build sunset decisions into your platform evaluation process. Track ROI continuously. Without this phase, you'll be back in the same position within 3-5 years. I've seen it happen, and the second cleanup is always more expensive than the first because stakeholders lose trust in the process.

The Bottom Line

The most expensive technology decision you can make is not making one.

Every month you delay consolidation, your technical debt compounds. Every new platform you add without retiring legacy systems multiplies complexity. Every workaround you implement becomes permanent infrastructure that someone will inherit and curse you for.

The companies winning in digital transformation aren't the ones building the most innovative new platforms. They're the ones disciplined enough to turn off what doesn't work.

I've spent 20+ years watching organizations pour resources into shiny new builds while their legacy portfolio quietly drains millions. The greatest competitive advantage often comes not from what you build, but from what you eliminate.

Your technical debt isn't a technology problem. It's a strategic disadvantage costing you millions in opportunity and execution speed.

The question isn't whether you can afford to consolidate. The question is whether you can afford to keep pretending the problem will solve itself.

How do I convince stakeholders to retire systems they're emotionally attached to?

Lead with business impact. The "cost per user" analysis works better than any technology argument I've tried. When executives see that a legacy system costs $50,000 per active user annually, emotional attachment fades fast. Build a sunset roadmap that gives teams 6-12 months to migrate so they feel included rather than ambushed. At one pharmaceutical company, we turned the biggest system defender into our consolidation champion by involving him in designing the replacement workflow.

What if consolidation breaks critical business processes during migration?

Never attempt a "big bang" migration. I use a three-phase risk mitigation approach: run systems in parallel for 30-90 days, migrate non-critical functions first to stress-test workflows, and maintain rollback capability for six months post-migration. At Novartis, we consolidated 900+ websites with zero business disruption by treating each migration as a surgical procedure. Over-communicate timelines and dedicate support resources during transition windows.

How long should a typical enterprise consolidation project take?

Complexity dictates timeline, but 12-18 months is standard for comprehensive consolidation. You can achieve meaningful quick wins within 90 days by targeting obvious redundancies first. The Fortune 500 audit I referenced took six months for discovery alone, followed by 14 months of phased implementation. The mistake most organizations make is trying to address everything simultaneously. Start with systems that have fewer than 100 active users and no critical integrations. Those are your practice rounds before tackling mission-critical platforms.

Author: William Flaiz