Real-Time Attribution: Moving Beyond Last-Click in 2026

You already know last-click attribution is wrong. Every marketer knows it. Yet 73% of organizations still use it as their primary model, according to recent industry surveys.

The reason isn't ignorance. It's that the alternatives seem complicated, expensive, or both. And the attribution software market doesn't help. Vendors throw around terms like "data-driven models" and "algorithmic attribution" without explaining what any of it means for your budget decisions tomorrow.

This guide cuts through the noise. I've implemented attribution systems at organizations ranging from scrappy startups to 90-country pharmaceutical operations. The pattern is consistent: teams either over-engineer attribution (spending six figures on platforms they don't fully use) or under-invest (relying on platform-reported metrics that systematically lie).

There's a middle path.

Why Last-Click Attribution Costs You Money

Last-click attribution tells you which touchpoint closed the deal. It tells you nothing about what created the deal in the first place.

Consider this scenario: A prospect sees your LinkedIn ad, reads three blog posts over two weeks, attends a webinar, receives a nurture email, and finally clicks a retargeting ad before converting. Last-click gives 100% credit to that retargeting ad. Your LinkedIn investment looks like waste. Your content team can't prove ROI. Your webinar budget gets cut.

Next quarter, you double down on retargeting because "the data shows it works." Conversions drop because you've starved the top of funnel that was actually driving demand.

This isn't hypothetical. I watched it happen at multiple organizations before attribution became part of my standard diagnostic.

At one media company managing 100+ websites across 90 countries, we couldn't determine which landing pages actually performed until we built a proper analytics framework measuring time on page, pages per session, and channel source. Once we could see the full picture, campaign teams shifted budgets to high-performing pages and saw steady month-over-month improvement in engagement and media effectiveness.

The data was always there. The attribution model was hiding it.

Related: How AI is Redefining Campaign Attribution in Real Time

Attribution Models Explained (Without the Jargon)

Before comparing tools, you need to understand what you're buying. Here's the landscape:

Single-Touch Models

First-Click: 100% credit to the first touchpoint. Good for understanding demand generation. Bad for everything else.

Last-Click: 100% credit to the final touchpoint before conversion. The default in most platforms. Systematically undervalues awareness and consideration activities.

Multi-Touch Models

Linear: Equal credit to every touchpoint. Simple but naive. A prospect who touched 10 channels gives each one 10% credit, whether that touch was a 30-second website visit or a 45-minute sales call.

Time Decay: More credit to touchpoints closer to conversion. Better than linear, but still arbitrary. Why should a touchpoint three days before conversion get 2x the credit of one seven days before?

Position-Based (U-Shaped): 40% to first touch, 40% to last touch, 20% distributed across middle touches. Popular in B2B because it values both demand creation and deal closing. Still arbitrary, but the arbitrariness matches how most marketing teams think about their work.

W-Shaped: Adds a third anchor point at lead creation (typically form fill or demo request). 30% first touch, 30% lead creation, 30% last touch, 10% distributed to everything else.

AI/Data-Driven Models

Algorithmic Attribution: Machine learning analyzes your actual conversion data to determine credit distribution. In theory, this eliminates arbitrary weighting. In practice, it requires significant conversion volume to train properly (typically 200+ conversions per month minimum).

Media Mix Modeling (MMM): Statistical analysis of aggregate spend and results across channels. Works well for large budgets across many channels. Less useful for campaign-level optimization.

Incrementality Testing: Controlled experiments measuring the true lift from specific channels. The gold standard for accuracy, but expensive and slow to implement at scale.

Attribution Software Comparison by Business Type

The market splits into two camps: e-commerce/DTC tools (Shopify-focused, revenue-centric) and B2B tools (CRM-integrated, pipeline-focused). Choosing the wrong category wastes money.

E-Commerce & DTC Attribution

| Tool | Best For | Starting Price | Platform Support | Key Strength |

|---|---|---|---|---|

| Triple Whale | Shopify brands $1M-$40M | $149-$2,149/mo (GMV-based) | Shopify only | Simple dashboard, mobile app |

| Northbeam | Multi-platform DTC $10M+ | $1,000/mo+ | Shopify, WooCommerce, custom | ML-based attribution, LTV forecasting |

| Rockerbox | Omnichannel retail | $200/mo+ | Multiple platforms | MMM + incrementality testing |

| Cometly | Mid-market paid media | $400/mo+ | Most e-commerce platforms | Real-time server-side tracking |

| Growify | SMB e-commerce | Competitive | Shopify, WooCommerce | Affordable multi-touch |

B2B Attribution

| Tool | Best For | Starting Price | CRM Integration | Key Strength |

|---|---|---|---|---|

| Dreamdata | Mid-market B2B | Free tier / $999/mo | HubSpot, Salesforce | Full journey mapping |

| Bizible (Marketo Measure) | Enterprise | Custom (high) | Salesforce, Dynamics | Adobe ecosystem integration |

| HockeyStack | PLG SaaS | Custom | Most CRMs | Product usage attribution |

| CaliberMind | Complex B2B sales | Custom | Salesforce, HubSpot | CDP + attribution combined |

| Attribution | Affiliate + B2B hybrid | Custom | Multiple | Affiliate channel tracking |

Related: Building the Ultimate MarTech Stack: Essential Tools for 2025

Selection Framework by Business Model

E-Commerce Under $5M Revenue

You probably don't need dedicated attribution software yet. Start with enhanced e-commerce tracking in GA4 and UTM discipline across all campaigns. The ROI math doesn't work until you're spending enough on marketing to justify the platform cost.

When to upgrade: When you're running three or more paid channels and can't determine where to shift budget.

Recommended approach: Triple Whale or Growify if Shopify-native. Cometly if platform-agnostic.

E-Commerce $5M-$50M Revenue

This is where attribution software pays for itself. You have enough conversion volume to train models and enough ad spend at stake to justify the investment.

When to upgrade: When platform-reported ROAS diverges significantly from actual business results.

Recommended approach: Northbeam for serious multi-channel operations. Triple Whale for Shopify-centric brands prioritizing simplicity.

B2B with Sales Cycles Under 30 Days

Your attribution needs look more like e-commerce than enterprise B2B. Marketing automation platforms (HubSpot, Marketo) often have sufficient built-in attribution for these shorter cycles.

When to upgrade: When you can't connect marketing activities to pipeline value.

Recommended approach: Dreamdata free tier to start. HubSpot attribution if already in that ecosystem.

B2B with Sales Cycles 30+ Days

Long cycles with multiple stakeholders require account-level attribution, not just lead-level. You need to see how marketing influences entire buying committees over months.

When to upgrade: When marketing can't prove pipeline contribution beyond MQL counts.

Recommended approach: Dreamdata paid tier or CaliberMind. Bizible for enterprise with existing Adobe investment.

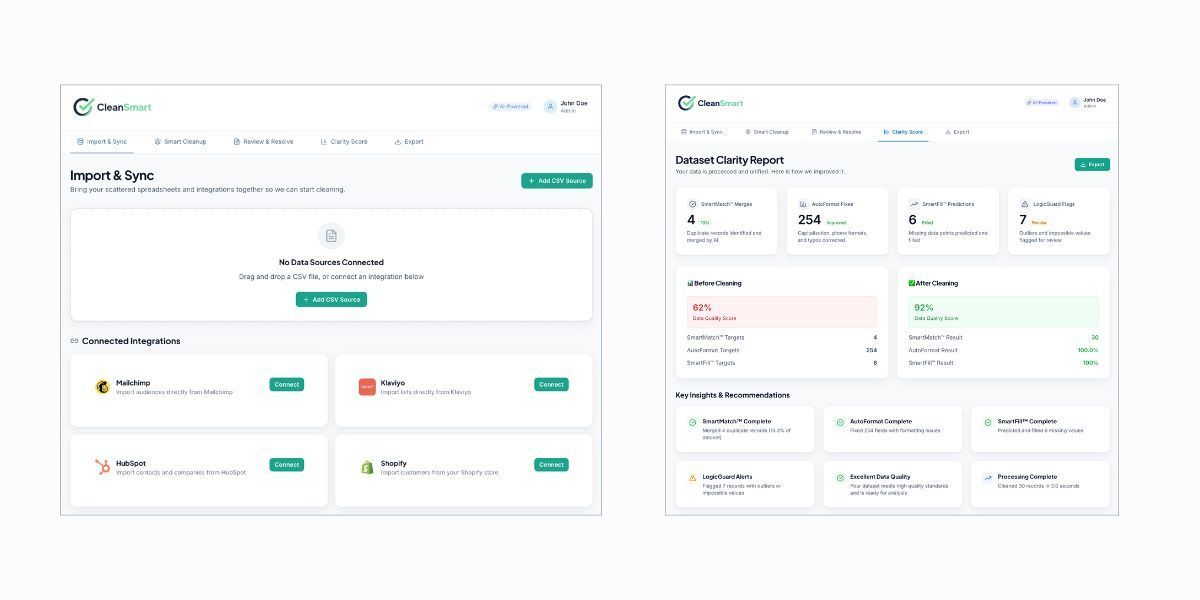

The Data Foundation Problem (Again)

Attribution software is only as good as the data feeding it. I've seen organizations spend $50,000 annually on attribution platforms that produce garbage insights because tracking was inconsistent.

Before evaluating any platform:

- UTM Hygiene: Are all campaigns tagged consistently? One team using

utm_source=facebookwhile another usesutm_source=Facebook_Adsbreaks attribution entirely. - Cookie Consent: Are you capturing enough user data to actually attribute? Aggressive consent banners can cut trackable sessions by 40-60% in some regions.

- CRM Data Quality: For B2B, can you match marketing touches to CRM opportunities? Duplicate contacts, missing company associations, and inconsistent lead sources all corrupt attribution.

Download: MarTech Data Cleanliness Checklist

At one company, we spent eight weeks cleaning 500,000 email contacts before implementing marketing automation with proper attribution. The result was a million-dollar revenue stream from email within eight months. Not because we bought fancy software, but because the foundation was solid.

What Real-Time Attribution Changes

Traditional attribution is backward-looking. You analyze last month's data to inform next month's decisions. Real-time attribution changes the game.

- In-flight optimization: Shift budget mid-campaign based on what's actually working, not what worked last quarter.

- Anomaly detection: Catch tracking breaks, fraud, or sudden performance shifts before they drain budget.

- Dynamic personalization: Adjust user experiences based on attribution-informed intent signals.

The catch: real-time attribution requires real-time data infrastructure. Most mid-market companies don't have the engineering resources to maintain it. Platforms like Northbeam and Rockerbox offer managed real-time capabilities, but you're paying for that convenience.

For most organizations, "near-real-time" (daily refreshes) delivers 90% of the value at a fraction of the complexity.

Related: From Data to Action: The Role of AI in Optimizing MarTech Stacks

Implementation Reality Check

Realistic timelines based on actual implementations:

- Basic multi-touch (platform native): 2-4 weeks. Configure attribution settings in HubSpot, GA4, or your marketing automation platform.

- Dedicated DTC attribution (Triple Whale, Growify): 2-4 weeks. Pixel installation, UTM cleanup, and platform integration.

- Full B2B attribution (Dreamdata, CaliberMind): 2-4 months. CRM integration, historical data import, model calibration, and team training.

- Enterprise implementation (Bizible): 4-6 months minimum. Often requires SI partner involvement and dedicated internal resources.

- ROI timeline: Expect 90-120 days before you can trust the data enough to make budget decisions. The first month is setup. The second month is catching tracking errors. The third month is when insights start becoming actionable.

Building Confidence in Attribution Data

The biggest challenge isn't technical. It's organizational. Marketing teams don't trust data that contradicts their intuitions, especially when that data suggests their favorite channels underperform.

Three practices that build confidence:

- Triangulation: Compare attribution data against incrementality tests and historical trends. If all three point the same direction, you can act confidently.

- Gradual adoption: Start by using attribution data for small budget shifts (10-15%) rather than wholesale reallocation. Build a track record before making major moves.

- Transparent methodology: Document exactly how your attribution model assigns credit. When stakeholders understand the logic, they're more likely to trust the outputs.

I learned this building a predictive algorithm for a high-stakes environment where every prediction had real financial consequences. Confidence scoring mattered as much as accuracy. The same principle applies to marketing attribution: teams need to know how confident they should be in any given insight before they act on it.

The "Good Enough" Attribution Stack

Not every organization needs algorithmic attribution and real-time dashboards. For many, a simpler stack delivers most of the value:

Tier 1 (Essential):

- Consistent UTM taxonomy across all campaigns

- GA4 with enhanced e-commerce or B2B event tracking

- CRM with marketing source tracking

Tier 2 (Growth Stage):

- Dedicated attribution platform matching your business model

- Regular attribution reporting cadence (weekly or bi-weekly)

- Documented process for budget reallocation based on insights

Tier 3 (Enterprise):

- Multi-model comparison (position-based vs. data-driven)

- Incrementality testing program

- Attribution data integrated into forecasting and planning

Most companies should master Tier 1 before investing in Tier 2. I've seen too many organizations skip straight to expensive software without fixing the foundational tracking issues that make all attribution unreliable.

Making the Decision

The selection process that works:

- Define your primary question. "Which channels drive revenue?" differs from "Which content moves deals forward?" The answer determines tool category.

- Audit your data foundation. UTM consistency, tracking coverage, CRM hygiene. Fix gaps before platform shopping.

- Match tool to business model. E-commerce tools for e-commerce. B2B tools for B2B. Category mismatch wastes budget.

- Start with free or low-cost tiers. Dreamdata, HubSpot attribution, and GA4 all offer entry points. Prove value before scaling investment.

- Plan for adoption, not just implementation. Budget for training, documentation, and the organizational change required to actually use attribution insights.

Attribution software doesn't solve attribution problems. It surfaces them. The real work is building the organizational discipline to collect clean data, interpret it honestly, and act on what it reveals.

What's the minimum conversion volume needed for data-driven attribution models?

Most AI-driven attribution models require 200+ conversions per month to produce statistically reliable results. Below that threshold, the models don't have enough signal to distinguish meaningful patterns from noise. For lower volume businesses, position-based models (U-shaped or W-shaped) provide reasonable approximations without requiring algorithmic training.

Can attribution tools work across both online and offline touchpoints?

B2B attribution platforms (Dreamdata, CaliberMind, Bizible) handle offline touches like sales calls, events, and direct mail when properly integrated with your CRM. E-commerce tools primarily focus on digital touchpoints, though some offer call tracking integrations. The key is ensuring offline activities get logged consistently in your CRM with proper timestamps and campaign associations.

How do privacy regulations (iOS 17, GDPR) affect attribution accuracy?

Privacy changes have reduced trackable user sessions by 20-50% depending on audience and region. First-party data strategies (server-side tracking, authenticated user journeys) partially compensate. Modern attribution platforms use probabilistic modeling to fill gaps, but accuracy has declined across the industry. This makes incrementality testing more valuable as a complement to deterministic attribution.

Author: William Flaiz